The top retail store trends heading into 2024

Retailers are still disrupted. Consumers are still uncertain. Recession may still be right around the corner.

In many ways, 2024 looks poised to be “2023: the Sequel.”

But with a wrinkle. Overall global deflation means retailers must sell more units to reach their revenue goals, versus relying on higher prices like in recent years. All while shoppers continue to expect more and different from their retail experiences.

Macroeconomic and consumer conditions may ring the alarm, but it’s important not to overreact. The retail industry is still in the middle of its post-pandemic journey. Any hard pivots or big, sweeping reactions can risk undoing the progress you’ve already made. In 2024, retailers should think more in terms of rising up, rather than radically shifting, their experiences.

In other words, 2024 may be more of a reboot than a sequel: give people what they want, stick with what works and innovate what no longer does. The best place to achieve this is through the store, the centerpiece of more than 70% of shopping journeys to this day.

In this blog post, we explore the top retail trends in 2024 from the store perspective. You’ll learn what’s changing, what’s sticking and where to go next. Here’s what's on the horizon for 2024.

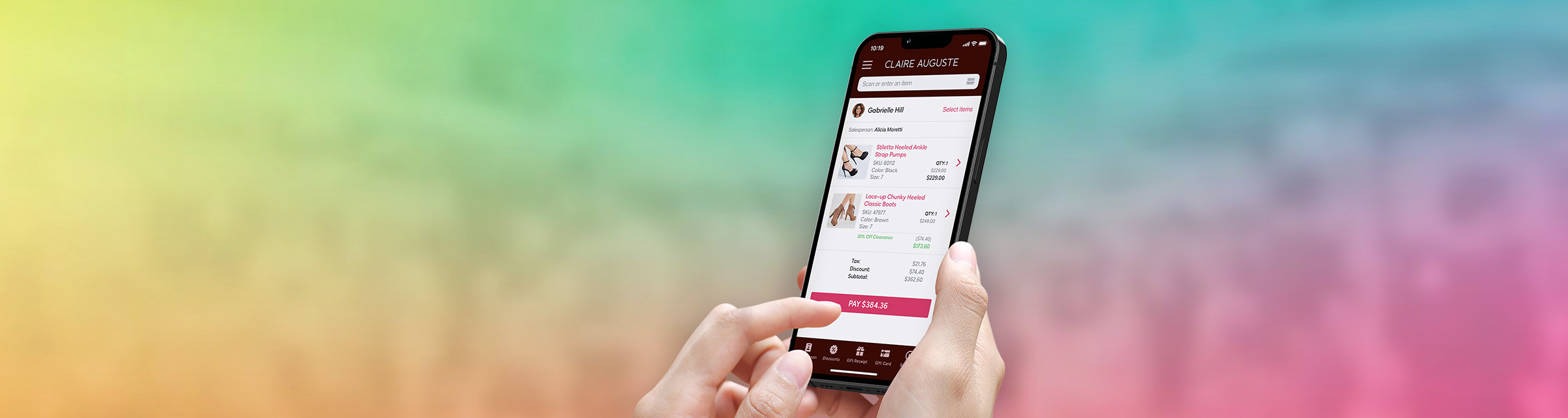

Mobile Point of Sale will bring back the personal touch

Self-checkout was once thought to be the cure-all for some retail verticals, promising shorter lines, less labor and a more independent shopping experience. Retailers may have over-indexed. While it remains a preferred experience for some shoppers, others look at it as a point of friction in theirs.

In 2023, many retailers began to pull back on self-checkout. It started in the UK with Booths, who removed self-checkout stands in all but their two busiest locations. Their reason? Living up to customer demand and their brand promise.

Major retailers are following suit: Wal Mart began paring back self-checkout in some stores as part of their “location by location approach” (more on that later), while Target now limits self-checkout purchases to ten items to shorten lines.

This shift to a more nuanced checkout approach attuned to local preferences and smooth experiences underline the increased interest in in-store Mobile Point of Sale (mPOS), a planned investment for 82% of retail executives in the US, UK and Canada.

mPOS solutions solve for many of the time benefits of self-checkout, while giving stores the flexibility to deliver modern experiences, shoppers the personal interaction they may seek and retailers the insight to meet localized demand.

More brands will engage in Store-within-a-store partnerships

The Store-within-a-store (SWAS) model will continue to trend as retailers seek to replicate their peers’ successes, drive more traffic to their stores and reach a wider range of customers.

SWAS partnerships provide a lot of potential upside for retailers in 2024:

Increased store traffic

Retailers can tap into each other’s existing foot traffic without the costs of opening new stores by partnering with each other. This can go a long way in preserving the higher margins gained when shoppers buy in stores versus delivery and other in-demand channels.

Larger customer base

SWAS partnerships allow both retail brands to reach customers they might not otherwise get in front of. Retailers can either partner with brands that would likely appeal to their shoppers or use it as an opportunity to expand into a new customer segment.

New store experiences

Different store types also expose retailers to different segments. For example, a retailer that mostly operates stores in a mall can more easily reach shoppers in the suburbs, while their partner brand can diversify their store experience, fully integrated from the consumer perspective.

Better resources

Partnerships allow the host retailer to reallocate resources in categories where specialty retailers excel. And with Unified Commerce technology, retailers can optimize their mutual inventory management strategies, omnichannel operations and more.

Localized store strategies will give retailers more leverage

Leveraging the store has been a major trend over the last few years. In 2024, that trend will strengthen and broaden.

As reflected in the growth of mPOS and SWAS, retailers are looking to win organically with the stores they already have. And thanks to cloud POS capabilities, retailers can localize their strategies to maximize their leverage.

As Nikki Baird, Vice President of Strategy at Aptos, told Forbes:

“Retailers should employ a portfolio approach to any geography where they place stores. This includes thinking about all the customers they serve within an area and then considering the right combination of store formats and product assortments to serve unique groups.”

Each location has its advantages. One store, for example, can drive in-store experiences while another can focus on omnichannel fulfillment. With data insights sourced from each cloud POS device and updated across the enterprise as close to real time as possible, retailers can allocate and replenish assortments based on local demand. And much more.

Retailers with cloud-native, modern mPOS solutions are best equipped to meet local consumer demands and global enterprise goals, and everything in between, simultaneously.

Key Takeaways

- 2024 will carry over some conditions from previous years, plus deflation.

- A store-centric strategy will put retailers in the best position to succeed this year.

- mPOS gives shoppers the personal experience they are demanding more of.

- Strategic SWAS partnerships make expansion easier and more effective.

- Retailers will continue to leverage stores with renewed focus on localization.

Aptos unifies the retail experience and the enterprise through modern mPOS, giving you the capabilities to keep pace with store trends in 2024 — and the agility to adapt as those demands change.