Retail + Tax Trends: What to Watch in 2024

For retailers, selling is a multi-front challenge: they offer a broad variety of products, on multiple channels, to customers in locations around the world. That creates significant complexity at every step for sellers and buyers alike. That's why so many retailers choose Aptos to unify commerce and streamline the customer experience.

Selling all those products, in all those channels, to all those customers—in all those locations— complicates tax compliance, too. Year after year, this complexity continues to grow: New regulations are passed, existing rules are revised and companies make changes to products, markets and other aspects of their operations.

That's why so many companies choose automated solutions from Avalara, a longtime leader in tax compliance. Avalara helps retailers navigate the ever-evolving web of sales tax requirements with tools that are updated when rules and regulations change—for transactions in every channel, and for buyers across thousands of jurisdictions.

Tax Changes 2024: anticipating what's ahead

While reacting quickly to regulatory changes is important (and a strong argument in favor of automation), anticipating what's ahead can help businesses take a proactive approach to compliance—and take advantage of trends.

That's the idea behind Avalara's Tax Changes 2024 guide, written by experts who live and breathe this stuff. It highlights what they see as emerging trends impacting tax compliance and operations in a variety of industries, including retail. You can download the full guide here, but read on for some interesting takeaways.

5 retail trends to watch

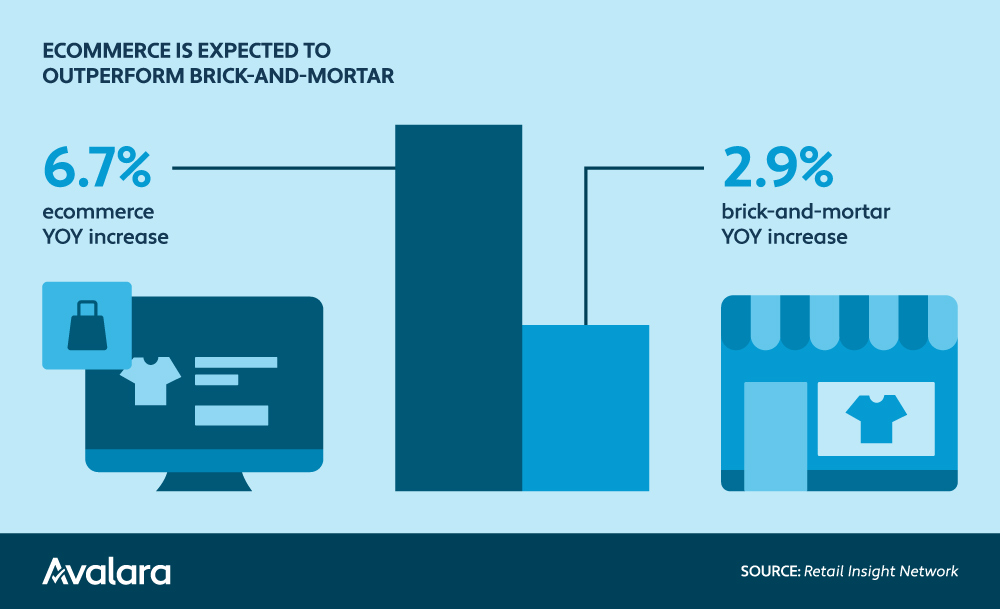

- The store matters more than ever. While eCommerce growth continues to outpace brick-and-mortar sales, the primary point of purchase is still the physical store, which accounts for 70% of retail sales. And the actual store has more of an impact on online sales than you might think. For instance, many customers who order online like the ability to return in-store. Others might have an item shipped to the store for pickup. And when a customer comes into the store, good things (such as additional purchases) often happen.

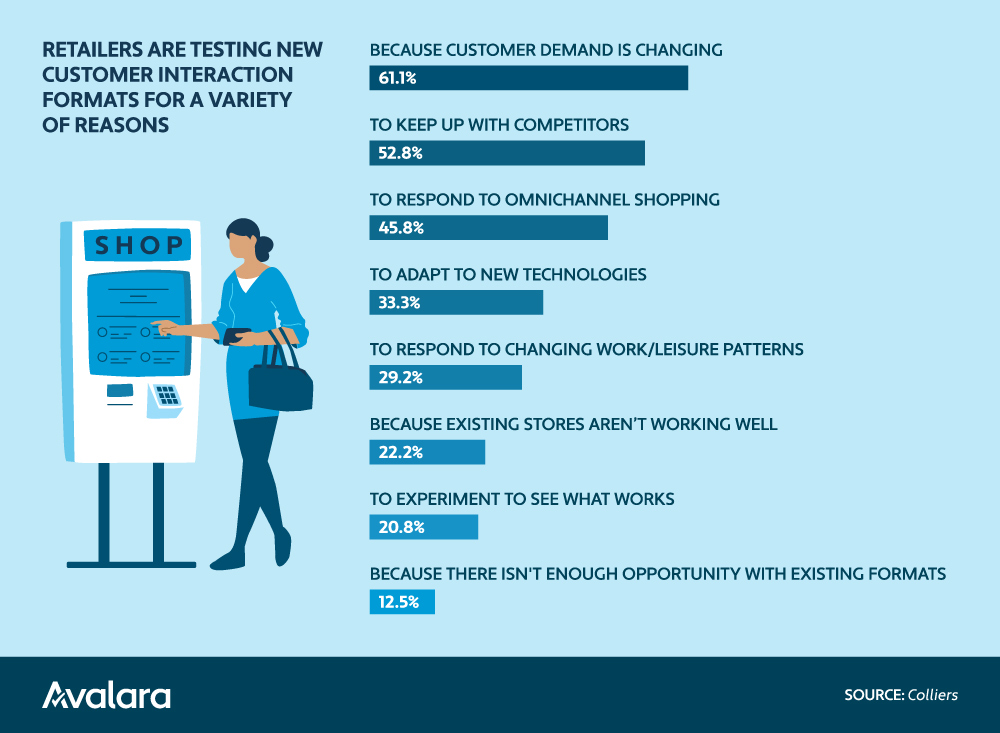

- Store experiences are becoming simple, local and flexible. Retailers are taking new approaches to create true brand experiences for customers. Today, brands are using local customer data to adapt store formats, assortments and sales floors at the location level. A good example is New Balance, whose flagship store utilizes a clean, simple shopping experience that conceals a constantly changing but choreographed merchandise strategy.

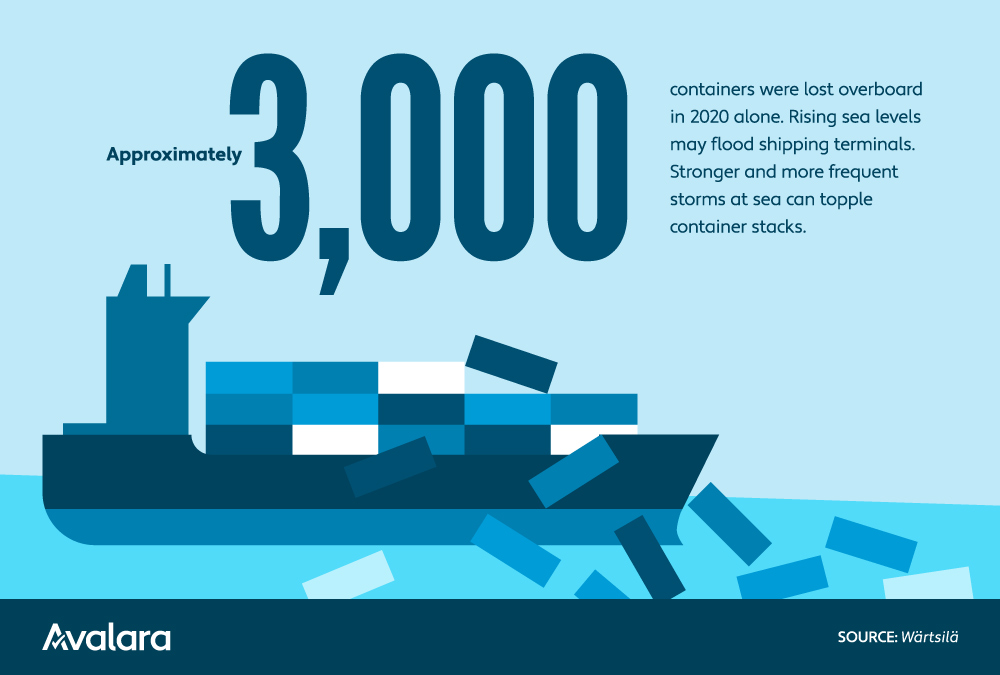

- The supply chain could be increasingly unstable. The supply chain has largely recovered from its well-publicized difficulties, but an array of challenges are looming. Climate change is one—drought slowed shipping through the Panama Canal in 2023, while rising sea levels and stronger storms may impact ports and container ships. Strikes and cargo thefts are other key issues. And you never know if (when?) another pandemic will arrive.

- Buy now, pay later (BNPL) is growing in popularity. BNPL programs were expected to drive $17 billion in online spending during the 2023 holiday season, and the global BNPL market has been estimated at nearly $150 billion. These transactions, essentially small-scale loans, likely will see increased regulation. They have sales tax implications as well, but naturally, states don't take a uniform approach. Aptos and Avalara can help ensure these unique transactions are documented—and taxed—appropriately.

- Retail delivery fees are becoming more common. As online buying continues to grow, so does the number of delivery vehicles on the road—which impacts the roads themselves, not to mention traffic. At the same time, state fuel tax revenues are declining thanks to electric vehicles and advancements in fuel efficiency. That's why some states have implemented, or are considering implementing, retail delivery fees (RDFs). Adding yet another layer of complexity to online sales, these fees need to be reflected in invoicing systems and other compliance functions.

3 Tax trends to watch

Getting sales tax right is essential because it impacts customer experiences—and retaining customers is as critical as finding new ones. Most of the trends above have some impact on compliance, but there are plenty of tax-specific trends for 2024 as well. Here are just a few:

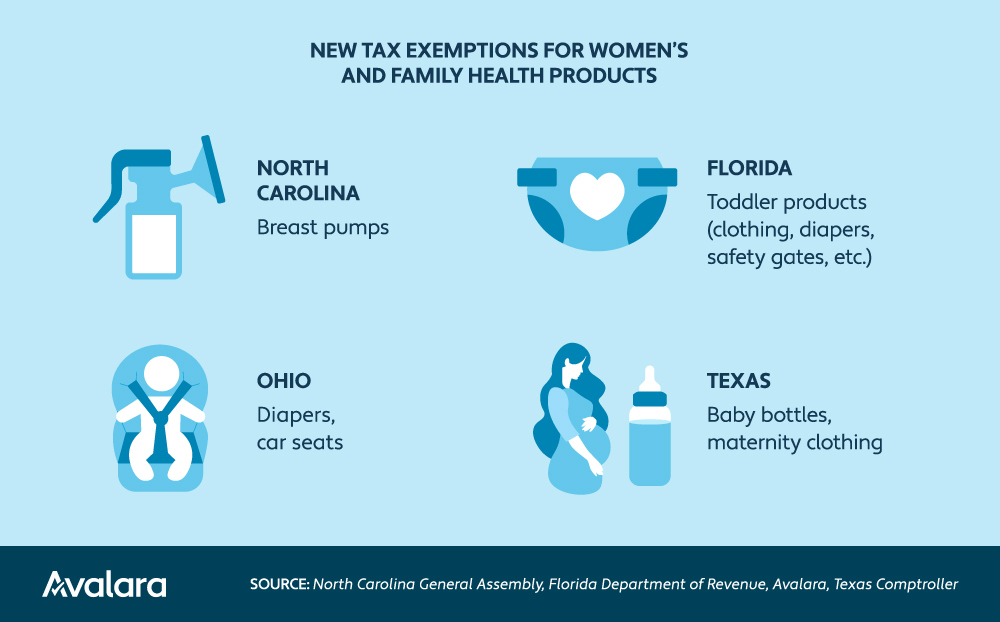

- Sales tax exemptions are on the rise. States are always changing their tax laws, and even when those changes benefit consumers, they can pose challenges for retailers. Exemptions for specific items or categories, such as food or personal hygiene items, are growing in popularity across the U.S. And some states that aren't fully exempting items are reducing rates on them.

- New taxes are coming, too. It's not all about exemptions, though: Many states are introducing taxes on previously untaxed items and services. In 2024, notable changes include taxes on firearms and/or ammunition in California, New York and Wisconsin; Avalara also anticipates new laws related to ticket sales and fees.

- More states are likely to give consumers a holiday from tax. There were nearly 99,000 sales tax holiday rule updates in 2023. Florida and Texas are known for their tax holidays, but experts expect to see them increase in other states as well—which will also increase the administrative burden on businesses.

Want to learn more about 2024 Tax Changes? Register here to join the Avalara Tax Changes webinar happening on March 28, 2024.

How Avalara can help

Automated tax compliance tools from Avalara—from calculation to filing and remittance, exemption management, cross-border solutions and more—integrate seamlessly into the Aptos tools you already use. And Avalara Tax Content for Retail (TCR), the company's retail-specific SaaS application, delivers regularly updated, deeply researched tax content to replace manual compliance and data transformation processes.

Designed to adapt and pivot along with your business, these flexible solutions help you lower the risk of costly errors while freeing up resources that can be allocated to more profitable initiatives.

"I didn't want to focus on our tax compliance or have people focused on making sure we were staying up to date with all the tax rate changes and all the new laws and everything else that comes about with taxation. Our goal was to make this company successful. Avalara allows us to do this. (Avalara) lets somebody that's much smarter than us worry about taxes so we can focus on running our business."

- CIO, RETAIL AND MANUFACTURING, from The Total Economic Impact™ Of Avalara, A Forrester Total Economic ImpactTM Study Commissioned By Avalara, February 2024

In an omnichannel industry filled with complexities, retailers seek powerful tools that deliver streamlined, efficient experiences, both for customers and their own operations. It's why so many choose Aptos—and precisely why they should consider Avalara as well.

To learn more, visit the Avalara website or connect with Avalara here.