Technology in vogue: The state of Unified Commerce in softlines retail

You may not see it in store windows along the sidewalks of 5th Avenue in New York, and you certainly won’t see it on the runways of Paris and Milan. Nor are you likely to see Avani or Camila Coelho sharing it in stories on their Instagram timelines. And you will for sure have to look beyond the pages of Elle, Allure or W magazines to see it.

But if you take just a moment to look beyond the glitz, gloss and glamour, you will quickly see that Unified Commerce is definitely in vogue this spring.

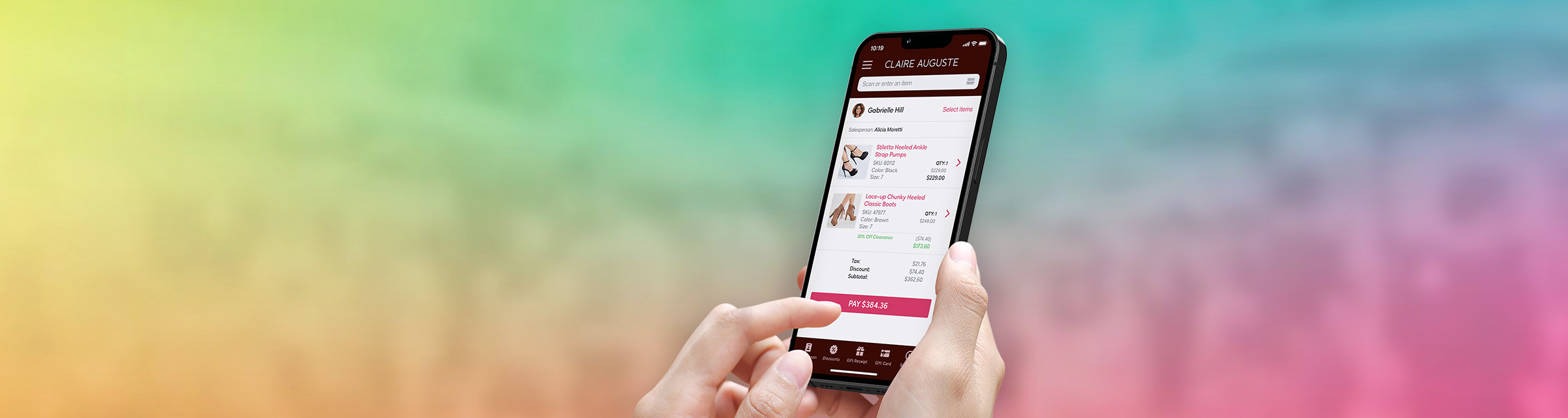

More and more stores like The North Face and New Balance are lining the sidewalks with associates who are always prepared to put their best foot forward with Unified Commerce. Influencers like Gartner and Forrester are posting about it regularly, albeit on LinkedIn more than TikTok.

New research sheds light on the latest technology trends

We can see the trend lines come quickly into focus with a quick perusal of the latest publication from Aptos, “The State of Unified Commerce in Softlines Retail.” While perhaps not quite as glossy as Elle or Allure, this nonetheless easy-on-the-eyes iPaper reveals the technology trends that softlines IT leaders are leaning into this year. The research, sponsored by Aptos and produced in collaboration with Bain & Company, surveyed IT leaders from 120 softlines (specialty apparel, footwear, accessories and luxury) retailers in the US, Canada and the UK.

One only needs to flip to page two to see that Unified Commerce is all the rage with the survey respondents:

Why are these retailers all-in on Unified Commerce solutions? Because they know the potential impacts they can deliver to the entire business:

Fully 80% of the softlines retailers we surveyed expect Unified Commerce platforms to have a large impact on profitability, while a significant majority also expect large impacts on revenue, inventory and conversions. Collectively, those metrics represent the haute couture of retail KPIs, and their value to the health of the business is as long-lasting as that of a Michael Kors handbag.

So, now that we know the trendlines, how do retailers plan to bring these concepts from the runway to their stores? The retailers Bain surveyed gave us great insights into what they believe are the foundation pieces for their Unified Commerce collections:

They also identified technologies that they believe are nothing but a collection of passing fads:

Challenges are plentiful

Additionally, the survey identified obstacles that Unified Commerce could face as we attempt to take it to the streets of retail. Respondents warned that a lack of organizational alignment can easily make a Unified Commerce initiative come apart at the seams, and many of those we surveyed are indeed struggling to align:

Our experience with hundreds of Unified Commerce implementations has taught us that patchwork technology strategies lead directly to disjointed and sub-optimized customer experiences. If those disjointed technologies and strategies extend into the store – the source for >75% of most softlines revenues – that will complicate matters even further.

Unfortunately, there is a clear need for some serious alterations if most softlines retailers hope to achieve their unified store objectives:

It comes as no surprise, then, that C-suite executives have little confidence in their organizations’ abilities to achieve their Unified Commerce ambitions:

How to walk the walk with Unified Commerce

Our survey respondents made it clear that the challenges to delivering Unified Commerce are plentiful. The key question, of course, is did the survey reveal a roadmap to overcoming those challenges? We did, in fact, find strong consensus around several critical building blocks to Unified Commerce success:

Three keys to Unified Commerce success

The data in the survey aligned closely with our client experiences, which gives us the confidence to publish what we believe are the keys to Unified Commerce success.

- Organizational alignment on Unified Commerce strategy, technology and capital.

We recommend investing heavily in building consensus upfront, long before you invest in Unified Commerce technology. - Don’t underestimate the importance of store leadership in strategic decisions.

We believe store operations leadership should have a major influence on any Unified Commerce project, and we recommend that they have “a seat at the table” alongside marketing, ecommerce and customer experience executives. - The right technology stack is essential to unifying the in-store experience.

We believe the key is to invest in store technologies that help you further your Unified Commerce objectives and that also best meet the expectations of your specific customers. No two retailers’ customers look exactly alike, and neither should their store technology stacks.

After perusing the pages of this slightly-less-than-glossy report, I think you will find the message for softlines retailers is clear: in the push to keep pace with shifting customer tastes, preferences and expectations, Unified Commerce is indeed the new black.

Editor’s Note: The State of Unified Commerce in Softlines Retail iPaper was derived from research sponsored by Aptos and produced by Bain & Company. The full report covering all the verticals surveyed was originally published in Q4 of 2023.