Why retail CIOs are still investing in core merchandising solutions

With more than 100 retailers currently running Aptos Merchandising, it can be easy for us to assume that retailers will always recognize the value of core merchandising technology. After all, we think, they will always need to create styles, manage vendors, and buy, price, allocate, replenish and pay for the products that drive their business. Seems like a fair assumption to make, right?

Perhaps not.

I say that because CIOs today are faced with a constant onslaught of distractions. A constant stream of marketers vie for their attention — and their budgets — with the shiny object du jour. Whether it’s gen AI-based salespeople, self-driving delivery vehicles or RFID sensors on every shelf, there are plenty of shiny objects to distract a CIO with limited attention and even more limited resources.

In today’s distracted world, it’s clearly not safe to assume that CIOs will always recognize the importance of the technology responsible for acquiring, managing and moving the products that drive the business. But here’s the thing: Despite all the distractions, merchandising continues to be a hot topic. CIOs are engaging, they are evaluating, and they are investing. We have more retailers evaluating our merchandising solution right now than we have had in several quarters.

So why, in a world full of shiny objects, does core merchandising technology continue to be a priority for CIOs? Because the customer experience depends on it. Because if we can’t connect shoppers to the products they want to buy, someone else will.

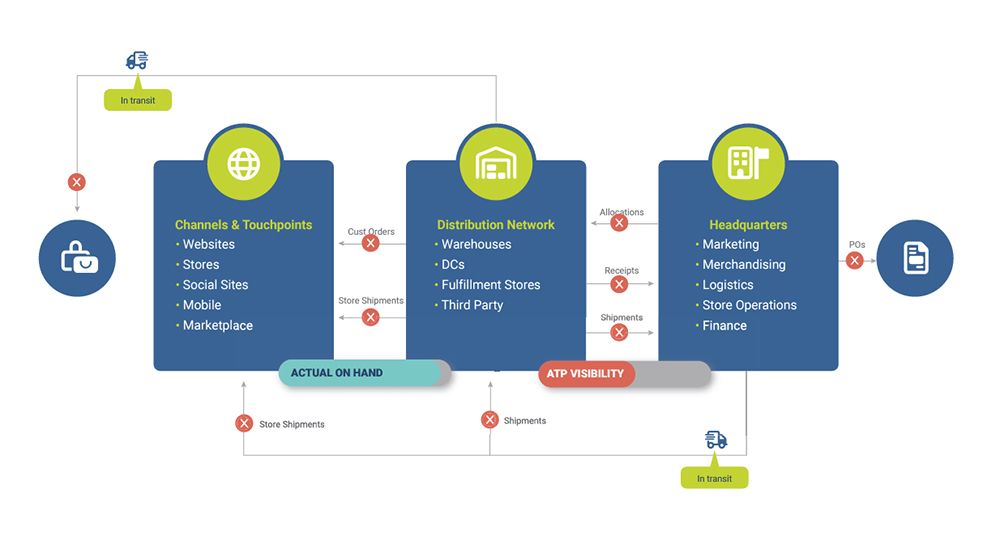

At Aptos, we talk frequently about the concept of “invisible” inventory — inventory that exists in the enterprise and is technically available for sale but is not visible to the people and systems that help shoppers find the products they seek. As inventory flows through the extended retail enterprise, there are countless opportunities for it to become invisible as it is handed off between locations, carriers, systems and suppliers.

Here are just a few of the more common ways inventory can easily become invisible to the people, processes and technology that empower omnichannel experiences:

- Stores: Sales, returns, receipts, transfers awaiting polling.

- Warehouses: Received but not checked in, shipped but not polled.

- Shipments: No visibility to in-transit status throughout the journey.

- Suppliers: No visibility to on-hand (or on-order) inventory.

- Merchandising: Awaiting overnight uploads from multiple third-party systems.

When inventory is invisible to the enterprise, it is impossible to sell anywhere other than in the store where it sits (assuming it sits on the sales floor). And if it’s impossible to sell, of course sales opportunities are missed time and time again, until the invisible inventory is once again visible to all the systems that depend on it. Most CIOs recognize that those missed opportunities will quickly add up.

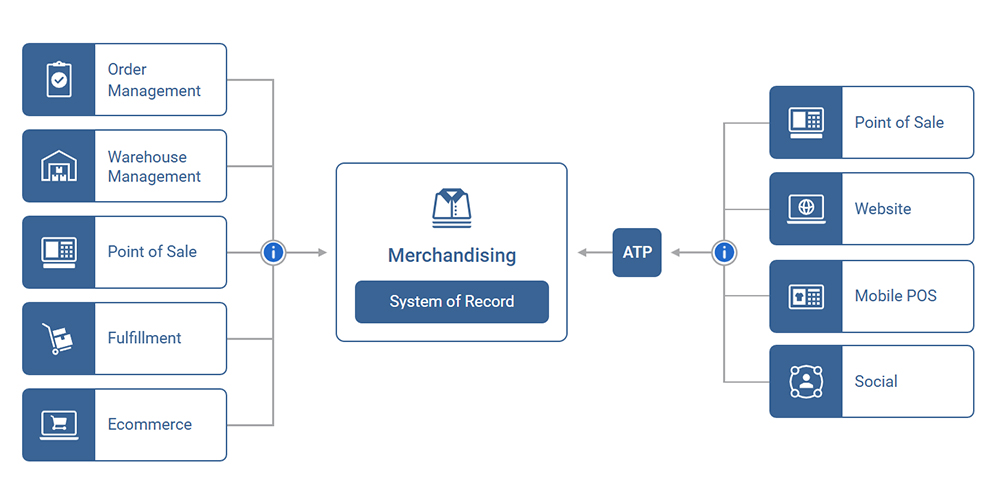

CIOs also understand that merchandising is the critical inventory system of record that feeds availability to all the selling channels, and that every merchandising feed or integration that lags behind real time puts inventory at risk of becoming invisible.

RELATED: How invisible inventory can sabotage Unified Commerce (interactive infographic)

While hypothetical lost sales opportunities concern CIOs, they tend to get very engaged in the conversation when they think about the impact of invisible inventory on specific customer experiences. Invisible inventory most commonly impacts individual customer experiences in two ways:

- Selling things you don’t own. Making promises you can’t keep (and taking payment for those promises) represents a serious customer service challenge and a serious threat to their ongoing loyalty.

- Not selling things you do own. In addition to being a lost-sales nightmare, invisible inventory creates a great risk of customers looking elsewhere for the products they seek. And once again, their ongoing loyalty is compromised.

RELATED: Overcoming invisible inventory (eBook)

There’s another area in which invisible inventory can impact profitability. When inventory becomes invisible to other core merchandising and order management solutions, costs inevitably go up:

- Merchants overbuy or over-allocate product to stores that are actually well stocked.

- Online orders are fulfilled from suboptimal locations because order sourcing tools can’t see stock available to ship in lower-cost locations.

- Markdowns go up because orders can’t be fulfilled from lower-volume stores if order management systems can’t see what’s on hand in those stores.

CIOs, despite all the distractions, understand that core merchandising solutions ensure that critical product and inventory data gets to all the right places — and that it gets there in time to positively impact decisions, promises and experiences across the enterprise.

Furthermore, CIOs recognize that core merchandising solutions help unify their business around one version of the truth by:

- Synchronizing and centralizing perpetually updated data.

- Maintaining item-by-item product status in as close to real time as possible.

- Integrating the stock ledger, consolidating enterprise reporting and matching invoices.

- Coordinating pricing across all channels, locations and banners.

When inventory data is flowing quickly and accurately across the enterprise, the enterprise can operate at maximum effectiveness, ensuring every customer has every opportunity to find every product they seek.

Which is a version of the truth every CIO can get behind.